Contents

- What is Liquidity Book

- Liquidity Book Key Features

What is Liquidity Book?

Welcome to the world of decentralized finance, where innovation and efficiency meet to create groundbreaking trading experiences. At the heart of this evolution is the Liquidity Book protocol, first developed by Trader Joe. You can think of Liquidity Book, as the engine inside of a car. Liquidity Book is underneath the Dusa platform connecting liquidity and trades to facilitate the various transactions taking place on the platform. Unlike traditional centralized exchanges, Liquidity Book doesn’t rely on order books. Instead, it utilizes a Pool of funds, provided by users, to facilitate trades directly on the blockchain. This means quicker, more efficient transactions and a decentralized trading experience that puts you in control. Liquidity Book stands out as a next-generation tool. It's designed to make trading tokens not just faster and more efficient but also more profitable for those who provide liquidity (the fuel that powers every trade). With its unique approach to managing and optimizing liquidity, it paves the way for everyone to benefit from the booming DeFi market. So, whether you're a seasoned trader or just starting out, Liquidity Book offers an intuitive and rewarding way to engage with the world of decentralized finance. Let’s dive in and explore how it's setting new standards in the DeFi universe.

Liquidity Book Key Features

Liquidity Book is more than just a trading platform, it's a hub of innovative features designed to benefit both traders and liquidity providers. Let's explore some of these key features:

- Concentrated Liquidity: Maximise your capital efficiency

- Surge Pricing: Liquidity providers earn more

- Bin Architecture: Flexible Liquidity Management

- Zero-slippage Swaps: Traders get the best trading rates

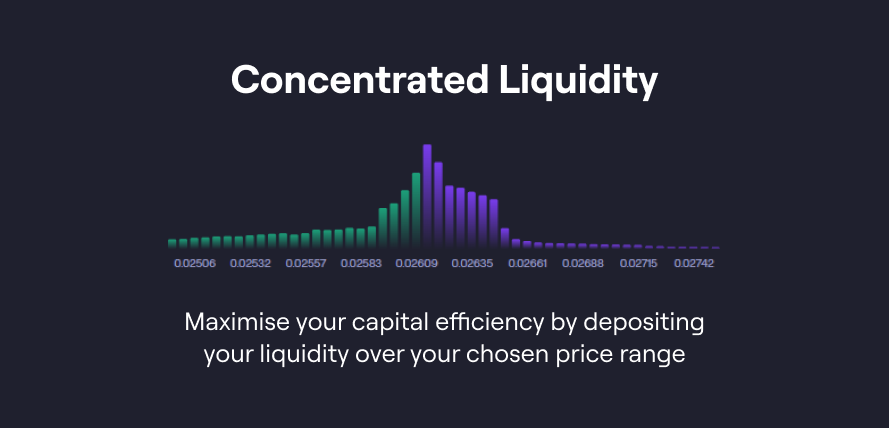

Concentrated Liquidity

Unlike traditional AMMs that spread liquidity across a wide price range, Liquidity Book allows liquidity providers to concentrate their funds within specific price ranges. This increases the efficiency of capital utilization which in turn helps to facilitate larger trades with less price slippage. For traders, this means more stable and predictable prices, while liquidity providers enjoy higher fee income potential.

Surge Pricing

In response to market volatility, Liquidity Book implements a dynamic surge pricing mechanism. This feature adjusts trading fees in real time based on market conditions. For traders, this means a slight increase in trading costs during volatile conditions, but for liquidity providers, it translates to higher fee earnings when the market is most active, compensating for the increased risks like impermanent loss.

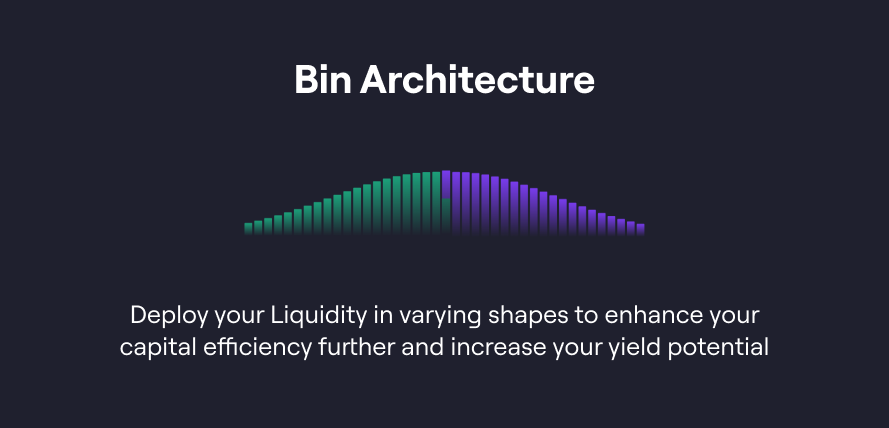

Bins Architecture

Liquidity Book uses a unique system of 'bins,' which are essentially segmented pools of liquidity at fixed price points. Each bin holds liquidity for a specific price point and every bin is aggregated together to form one complete Liquidity Pool. This innovative approach reduces price impact during trades, offering traders better price execution. For liquidity providers, the bins system allows for more strategic placement of funds, optimizing their earning potential based on market trends.

Zero Slippage Swaps

On traditional AMMs, the price of assets depends entirely on a pool composition, which changes during the swap. This means that each purchase pushes the price higher while each sale decreases it. This process occurs during each swap, meaning traders get worse prices than the quoted ones experiencing “slippage”. Thanks to its bin architecture Liquidity Book allows for swaps with zero slippage, meaning that advertised prices match the rates at which the trades were actually executed and as a Trader, zero slippage means your trade gets accurately priced and executes with greater efficiency.