Tokenomics

Key Highlights

$DUSA Token Belongs to the Community: Contributors, active users, and every member of the ecosystem.

Two Main Earning Mechanisms:

- Liquidity Provider Incentives

- Duser Distribution

Governance: Decentralized through a ve-model inspired by Velo and Aero, ensuring long-term alignment.

Projected public distribution Inflation: ${~7%} annually to balance growth and reward stakeholders.

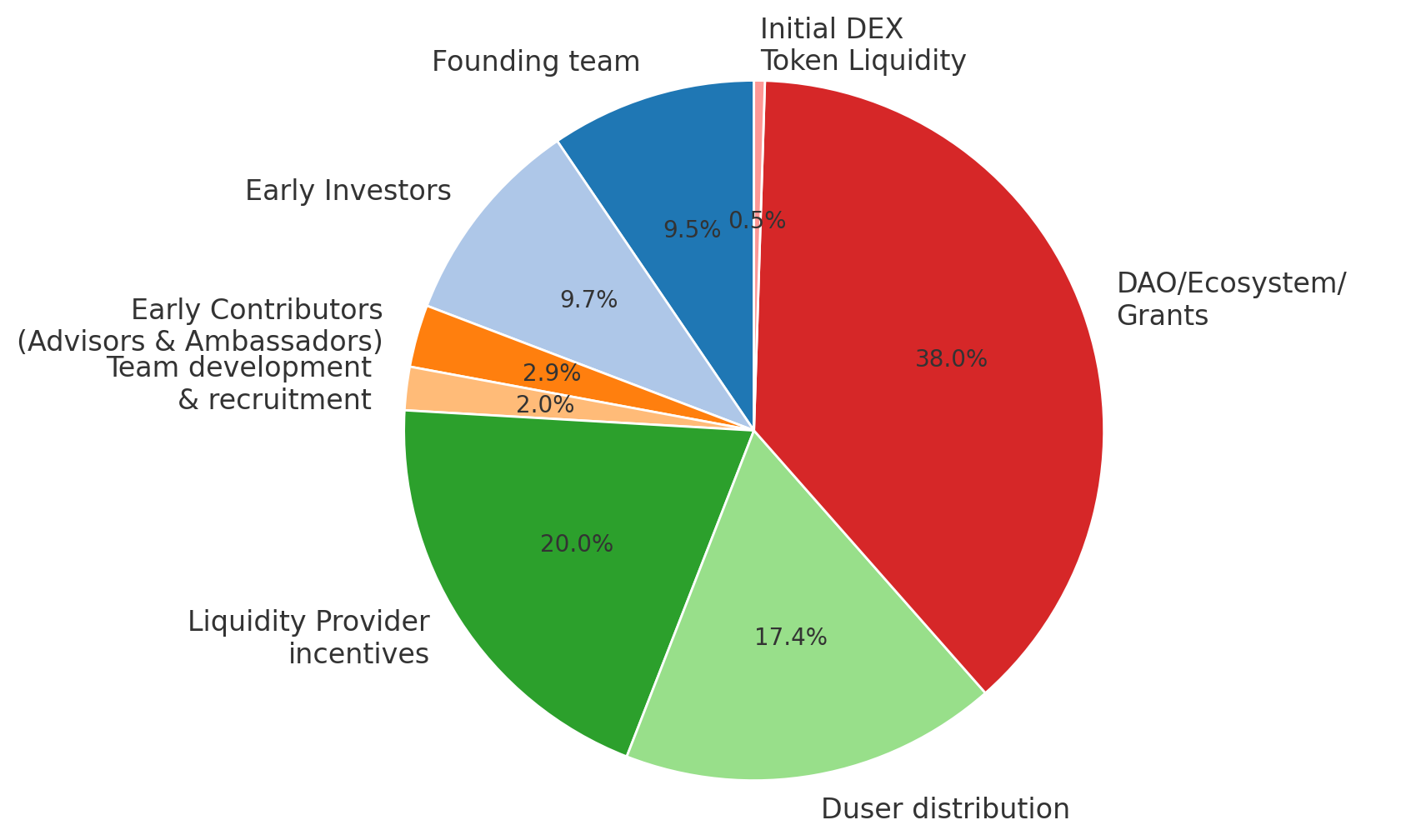

Total supply distribution

1. Total Insiders allocation 24.08%

Founding team: 9.5% - 9 months cliff, 2.5 year linear release

Early Investors: 9.7% - 3-6 months cliff, 2.5 year linear release; 0.6% of KOLs who invested $ to have this allocation with 10% TGE followed by 2 months of Cliff & 12 months linear release

Early Contributors (Advisors & Ambassadors): 2.88% - 9 months cliff, 2.5 year linear release for advisors which represent 1.78%; Ambassadors are subject to a 3 months cliffs and 18 months of linear release

Team development & recruitment: 2%

2. Total Community Allocation 75.42%

Liquidity Provider incentives: 20% - 0.75% TGE, 5 year linear vesting

Duser distribution: 17.42% - 2.42% distributed at TGE & 1.5% distributed to active Dusers every 6 months

DAO/Ecosystem/Grants: 38% - 10-year budget, vested, to be determined by the DAO by vote with 0.5% allocated to stacking incentives for the pre-revenue sharing

3. Initial DEX Token Liquidity: 0.5%

Governance & veDUSA Model

$DUSA token belongs to contributors, active users and every member of the community.

That’s why the two ways to earn $DUSA tokens will be by contributing to the protocol (Liquidity provider incentives) and using the protocol (Duser distribution).

Since the start of Dusa, we aim to offer advanced trading primitives in a fully decentralized way. That’s why, after the TGE, the DAO will be quickly implemented to direct the emission of $DUSA in the best direction for the growth of Dusa protocol.

Dusa governance model is inspired by already implemented and working ve-models such as Velo and Aero implementations.

Token holders will be able to lock their token over a period from 1 week to 4 years, which will give them a proportionate value of veDUSA reducing over time.

Example: If I lock 100 $DUSA for 1 year I will get 25 $veDUSA, while if I lock them for 4 years I will get 100 $veDUSA. It can be used to participate in governance

Here it’s only a traditional ve model to ensure that the DAO voters' interests are aligned with the long term growth of Dusa protocol.

In the traditional vemodel, the NFT is non-transferable. In our case (and the ones of Aero and Velo) it will be transferable to ensure no other layer is built on top of Dusa governance and try to extract value from our token emission other than the contributors (c.f. Curve wars). It also opens the possibility for users who encounter unpredictable issues to find an OTC deal.

Reward Mechanisms

With their veDUSA tokens, users can vote on the pool they believe is best suited for distributing $DUSA emission incentives. In return, they will earn a share of the fees generated exclusively by that specific pool.

The idea behind that logic is to incentivize the voter to allocate Dusa incentives to the most prolific pool for the protocol.

Every week the voters will be able to choose one pool or to continue to allocate their vote to the same pool.

Depending on the pool (regular/stable/degen), the voters will get 10-20% of the generated fees. The goal is also to deploy new pools with different fees set up to find the most optimal one to align LPs and holders interest.

Aside from Liquidity provider incentives, the other main distribution mechanism will be the Duser distribution. This mechanism is planned to distribute the 25% allocated $DUSA token over a 5 year period to the power users of Dusa.

During the first 5 years every week Duser will receive non-transferable $JELLY tokens depending on their weekly activity on the protocol, for example traders will receive a share of the weekly $JELLY pool calculated on their share of the weekly volume.

Even Liquidity providers will have access to $JELLY tokens boosting their APR on top of the earned fees and $DUSA incentives tokens.

Those $JELLY will give the ability to their holders to claim some $DUSA twice per year (every 6 months).

The idea of this mechanism is to ensure every stakeholder of Dusa first year's growth is valued and recognized.

The $JELLY distribution will also take into account the activity of the users over the previous token distribution to ensure that long term oriented users/contributors are always recognized for the growth of Dusa.

Conclusion

These two primary mechanisms are designed to secure the future growth of the Dusa protocol. The first ensures a long-term, decentralized governance model focused on allocating incentives in the most productive way.

Meanwhile, the second mechanism guarantees a fair distribution of rewards to all stakeholders. At the same time, it keeps the door open for newcomers to actively contribute to the protocol.

Those two mechanisms would set the public distribution inflation around 7% annually.